Lebanon is facing a multi-faceted crisis and many geopolitical challenges. The fiscal deficit, balance of payment deficit, unsustainable public debt, currency collapse, and historic financial sector crisis are but a few of the main factors plunging the country into an economic depression. This is, disastrously, driving poverty to reach more than 50 percent of the Lebanese population.

This economic and financial meltdown has multiple causes and consequences. These cover poor macroeconomic policies, financial distress, currency and maturity mismatches, poor regulations or supervision, inadequate control of risks, abysmal legal system, and political interference. It is also important to note that the COVID-19 impact and the Beirut port explosion compounded an already deteriorated economic environment.

Fiscal Status – Fiscal Problems and Public Debt

Fiscal problems1 have been building for years and the current crisis conditions have exacerbated Lebanon’s fiscal position. The problem that needs to be addressed is public debt. It has reached unsustainable levels because of numerous factors, including:

- years of continuous large fiscal deficits driven by high-borrowing interest rates.

- high current expenditures.

- a loss-making electricity sector.

- low levels of capital investments with delays in project implementation.

- inefficient tax collection.

- corruption and overspending.

Government Budget – Revenues vs Expenditures

The sharp contraction in economic activity with business closings and job losses, also causing severe social consequences, has contributed to a decline in revenues, the hardest hit being the Value Added Tax (VAT). Between January and August 2020, total revenues declined by 27 percent2. This decrease was driven by a 50 percent decrease in VAT revenues and a 34 percent decrease in customs revenues3.

Total expenditures have also decreased by 22 percent over the January – August 2020 period compared to the same period in 20192. The main factor behind this was the default on the interest payments on foreign currency debt (i.e. Eurobonds) which led to a decrease by 88 percent in government debt servicing yearly expenses; this has offset the decrease in revenues. Another factor is the 41 percent decrease in interest payments on domestic debt (i.e. LBP) [2]. It is believed that this decrease is attributed to an agreement between the government and the Central Bank in which the Bank would not receive the coupon payments on the treasury bills it holds as part of a fiscal relief plan for the government.

Furthermore, general expenditures have witnessed a slight decrease of 4 percent2. These include current expenditures, salaries and related items to the public sector, not to mention Électricité du Liban (EDL) transfers. Nonetheless, these expenditures dropped significantly in real terms due to the continuous increase in inflation.

In summary, Lebanon’s 2020 budget deficit has been estimated to exceed 6 percent of the nation’s Gross Domestic Product (GDP), a 5 percent decrease compared to the previous year (i.e. 11 percent of GDP).

Public Debt Explained

During the post-civil war reconstruction era, public debt increased by relying on domestic market borrowing. In the 1990s, the government tapped the international markets for foreign currency debt. In fact, the government has mostly financed its deficit by issuing treasury bills and by borrowing from the Central Bank. The high cost of borrowings increased the cost of servicing the public debt with interest payments representing 50 percent of government revenue in 20192.

For the first time in its history, Lebanon defaulted on a Eurobond debt payment of 1.2 billion US Dollars (USD), which was due in March 2020. Caretaker Prime Minister Diab justified the move as being necessary to address the sharp decline in the country’s reserves.

As of December 2020, Lebanon’s gross public debt reached 95 billion USD at the official exchange rate, divided into the following4:

- Domestic debt (Lebanese pound [LBP] bills) – around 59 billion USD.

- Foreign debt (Lebanese Eurobonds and other foreign currency debt including arrears5) – 36 billion USD, split as follows:

- 9 billion USD held by domestic banks.

- 5 billion USD of Lebanese Eurobonds held by Banque du Liban (BDL).

- The remaining amount is mainly foreign-held by investment funds, i.e. Ashmore Group Plc and Fidelity Investments, who were among the largest creditors6.

A year after its first sovereign default, the country is now considered one of the world’s most debt-strained nations. As per the World Bank report, the unsustainable debt to GDP ratio was projected to be 194 percent by the end of 2020 [3] compared to 176 percent of GDP in 20192 and 131 percent in 20127. Therefore, public debt restructuring is unavoidable.

Financial Sector – The Financial Crisis

Lebanon is undoubtedly entrenched in a very real financial crisis. This is made evident by the large and frankly absurd foreign currency mismatch in the Lebanese banks’ balance sheets, still widening today despite the banks’ unfair attempts to reduce and clean their balance sheets through transferring the losses to depositors.

In summary, the financial crisis is a result of the:

- long-standing monetary and fiscal policies.

- dried-up foreign deposits inflows.

- continuous deposit dollarization.

- toxic assets in the balance sheets.

- rising nonperforming loans and the depletion of BDL’s foreign reserves.

- unsustainable financial engineering.

- absence of a comprehensible plan that restructures and recapitalizes the financial sector [8].

In addition to the above and as of February 2021, 70 percent of the banks’ total assets were in the form of deposits at BDL and credit to the public sector. This has tremendously affected the banks’ financial health and their capacity for intermediation to the economic activity.

BDL – A Deteriorating Balance Sheet and Collapsing Monetary Policy [9]

BDL does not release its audited financial statements. However, the audited financial statements for the year 2018 were somehow leaked. These financial statements exposed that the Central Bank held around 33 billion USD of assets in foreign currencies, including:

- interest bearing time deposits maintained with international banks and central banks that fully matured in 2020.

- foreign bonds and certificate of deposits issued by foreign banks that fully matured in 2019.

- local assets in foreign currencies including the Eurobonds that BDL is currently holding.

Moreover, from December 2019 to April 15, 2021, BDL’s interim balance sheet shows that the value of foreign assets dropped by more than 15 billion USD [10]. Bear in mind that the breakdown and detailed allocations of the reduction in foreign assets are not disclosed transparently. This massive plummet has mainly been driven by BDL’s subsidization of various imports including basic commodities, food imports, and industrial raw materials. Also, it is important to note that an additional major cause of the downfall has been BDL’s intervention in the market to support the exchange rate and its liabilities in foreign currency to commercial banks.

Credits: Subsidization Table

The BDL balance sheet includes a large imbalance due to its monetary policies that eventually led to accumulated losses, a negative Foreign Trading (FX) position, and a liquidity gap. Therefore, restructuring is needed to rebuild a far more credible and transparent monetary system, restore the Central Bank’s viability and eventually regain confidence.

The Effects of a Collapsing Fixed Exchange Rate and Balance of Payments

The pressure is now on BDL’s foreign currency reserves after the stop in capital inflows [11] used to finance large current account deficits [12] with no rescue plan in sight. This has brought about:

- continuous depreciation of the LBP in the parallel market [14] and black market [15].

- mass money creation or money printing in LBP led by the Central Bank’s buying-time policy.

- a scarcity of USD.

- declining confidence in the Lebanese economy.

- other factors driving inflation up and pushing more people into poverty.

The peg [16] to the USD maintained since 1997 has led to an overvaluation of the LBP that encouraged an increase in imported goods through an artificial purchasing power. As of December 2020, the balance of payments deficit recognized a cumulative deficit of 5.85 billion USD compared to a 10.55 billion USD deficit in 2019. However, due to the continued subsidization policy, BDL’s net foreign assets fell by 14.27 billion USD. Consequently, the depletion of its reserves will put more restrictions on imports that Lebanon heavily relies on.

A Glimpse into the Private Sector

Lebanon’s private sector sales were down approximately 45 percent in 2020 compared to 2019 whilst the non-performing loans [13] ratio in the banks’ credit portfolio increased to 30 percent. As if to rub more salt into the wound, 23 percent of full-time employees in key sectors were laid off. Furthermore, the private sector will continue to contract in 2021 if political and economic reforms are not implemented and the COVID-19 vaccination programs are not rolled out in time.

The Solution: A Proposed Rescue Plan and Recommended Reforms

In 2020, the Lebanese government appointed Lazard, a financial advisory and asset management firm, to work on a rescue plan. It highlighted that the Lebanese economy is in free fall and emphasized the need for an international financial rescue package to halt the recession and create conditions for a rebound. The plan also suggested a list of critical reforms to promote a new economic growth model and restore confidence. The international community has promised to provide the necessary resources to Lebanon if authorities implement a comprehensive reform package and treat the imbalances over the past decades to eliminate the heavy burden on the economy. The International Monetary Fund (IMF) managing director Kristalina Georgieva supported this position during a global international conference that was addressed to the Lebanese people. She drew special attention to the fact that all institutions in Lebanon should come together to carry out much-needed reforms aimed at addressing the deepening crisis, strengthening governance and accountability and restoring confidence in the economy.

Required reforms include:

- restoring solvency of public finances to create the necessary buffers to protect public finances from future shocks and secure a long period of economic growth.

- restructuring of the banks in order to restore their financial viability, capacity to intermediate economic activity, and ability to regain public confidence.

- setting in place temporary safeguards to avoid continued capital outflows of current and future resources.

- taking upfront steps to reduce the protracted losses in many state-owned enterprises.

- an expansion of the social safety net to protect the most vulnerable people.

In summary, many solutions and tools exist to overcome the deepening crisis but as expected, none have yet been implemented.

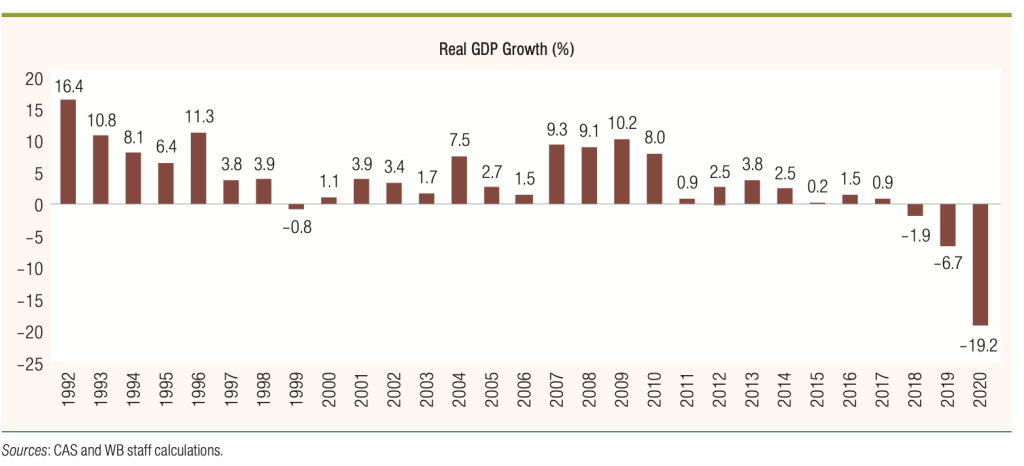

Credits: Historical GDP Graph

1 A fiscal policy is the means by which a government influences the economy of a country. Examples include government spending allocations and the taxing system.

2 Summary of Fiscal Performance, 2019. (n.d.). Retrieved April 23, 2021, from http://www.finance.gov.lb/en-us/Finance/EDS/FP/2019/Dec%202019en.pdf, Republic of Lebanon, Ministry of Finance and Summary of Fiscal Performance, 2020. (n.d.). Retrieved April 23, 2021, from http://www.finance.gov.lb/en-us/Finance/EDS/FP/2020/Sep%202020en.pdf, Republic of Lebanon, Ministry of Finance

3 Summary of Fiscal Performance, 2020. (n.d.). Retrieved April 23, 2021, from http://www.finance.gov.lb/en-us/Finance/EDS/FP/2020/Sep%202020en.pdf, Republic of Lebanon, Ministry of Finance

4 General Debt Overview, 2005 – 2021. (n.d.). Retrieved April 29, 2021, from http://www.finance.gov.lb/en-us/Finance/PublicDebt/PDTS/Documents/General%20Debt%20Overview%20Updated%20as%2031%20January%202021.pdf , Republic of Lebanon, Ministry of Finance

5 Arrears can be defined as overdue debt unpaid for a period of time.

6 Ashmore is a specialist emerging markets investment management company based in the United Kingdom and Fidelity is an American multinational financial services corporation based in Boston

7 Summary of Fiscal Performance, 2012. (n.d.). Retrieved April 29, 2021, from http://www.finance.gov.lb/en-US/Finance/EDS/FP/Documents/Dec%202012en.pdf, Republic of Lebanon, Ministry of Finance

8 A comprehensible plan for the banking sector can begin with asset quality review, through which factors like portfolio diversification, operational efficiencies and the magnitude of regulatory frameworks in limiting credit risks, are assessed. This review can then be aligned by a full rescue plan.

9 Defined by the central bank, mainly in relation to money supply, currency, and interest rates.

10 BDL Interim Balance Sheet, 2021. (n.d.). https://www.bdl.gov.lb/tabs/index/6/287/BDL-Balance-Sheet.html, Banque du Liban

11 The amount of capital coming into a country. For example, in the form of remittances or foreign investments.

12 When a country imports more than it exports in value, payments going out to foreign countries are higher than the revenues entering the country.

13 Licensed exchange outlets who “follow the rules” dictated by BDL and the government.

14 Illegal exchange shops or individuals operating without regulation.

15 A fixed exchange rate between a national currency and a foreign currency or a basket of currencies.

16 A loan in which the borrower has not paid their monthly principal and interest payment for a specified amount of time, usually 90 days.

Margueritta is a financial consultant and expert in International Financing Reporting Standards (IFRS). She has worked in different fields including finance, economics, risk management, venture capital and business planning. She also has a Master of Business Administration (MBA) from Pantheon-Sorbonne in Paris, France, and is a certified accountant, admitted to the Association of the Chartered Accountants (ACCA) in London. She is very active on Twitter, mainly focusing on analyzing and projecting the economic and financial situation in Lebanon.

-

This author does not have any more posts.